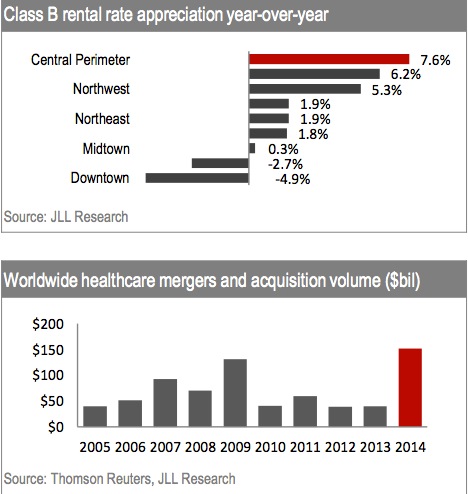

Now that we have comfortably transitioned into the second quarter, let’s have a quick recap of the market forecast from the first quarter. Jones Lang Lasalle notes that declining vacancy rates and higher rents for office space in Atlanta have translated into fewer options for tenants and more opportunities for investors. In the past few months, Atlanta has experienced an economic resurgance that has manifested itself into a sequence of corporate relocations and expansions. Most of the large blocks in “Class A” buildings have disappeared over the last 12 months. And with no development to soothe this pressure, landlords of “Class B” space are jumping to action resulting in “Class B” rates increasing in seven of the nine Atlanta Submarkets year-over-year.

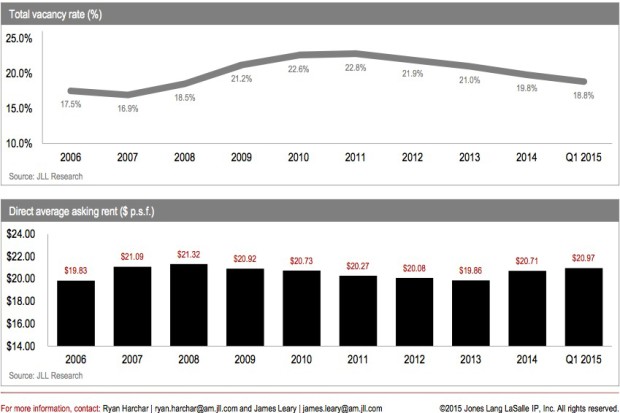

Mergers and Acquisitions will likely impact office processes near-term, mainly in the healthcare sector which holds 5.5 percent of Atlanta’s office inventory. Accelerated by recent legislation and shareholder expectations to cut costs, Atlanta’s value is likely to draw new demand resulting from real estate strategy. Of more than 1 million square feet of “Class A” office space currently under construction, 17.9 percent has been preleased. Overall, the direct asking rate for “Class A” and “Class B” office space with a combined averaged is $21.03 per square foot, and the total vacancy rate of 18.8 percent in the first quarter was the lowest since the last quarter of 2008, with a rate of 18.5 percent.

All information is provided by Jones Lang LaSalle. Data is deemed reliable but not guaranteed.